Home Loan EMI Calculator

Introduction to Home Loan EMI

When you decide to purchase your dream home, taking out a home loan often becomes a necessity. Home loans are a financial product offered by banks and financial institutions that allow you to borrow money to buy a house or property. In return, you agree to repay the borrowed sum over a specified period in the form of Equated Monthly Installments (EMIs).

An EMI is a fixed monthly payment that you need to make to the bank or financial institution from which you have taken the loan. The EMI is designed to help you pay off both the principal amount and the interest charged on the loan, making it easier to manage your finances without stressing over a large lump-sum payment.

What is a Home Loan EMI Calculator?

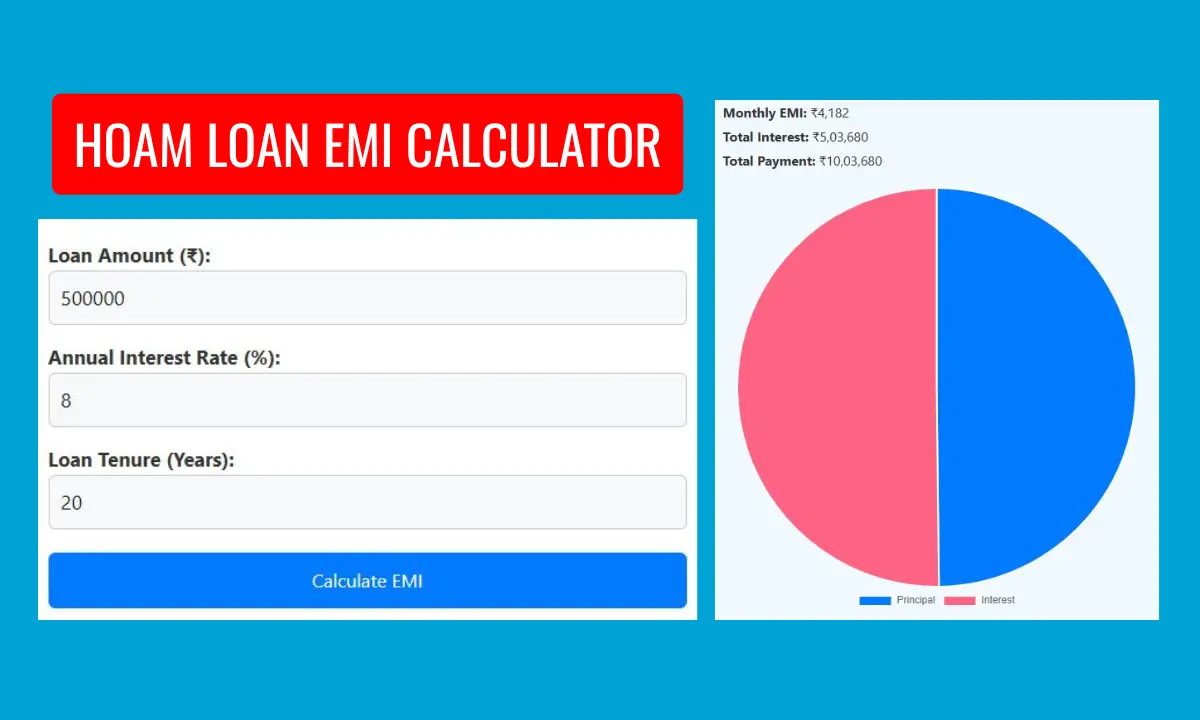

A Home Loan EMI Calculator is an online tool that helps you estimate the monthly EMI you’ll have to pay for a particular home loan. By inputting the loan amount, interest rate, and loan tenure, you can instantly calculate the EMI you need to pay.

The formula for EMI calculation is as follows: EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1}

Where:

- P = Principal Loan Amount

- r = Monthly interest rate (annual interest rate divided by 12 and then divided by 100)

- n = Loan tenure in months (years * 12)

This simple formula helps you understand your monthly obligations so you can plan your budget more effectively.

Understanding Home Loan EMI in India Based on RBI Guidelines

In India, home loans are governed by several RBI-regulated banks and financial institutions. These banks adhere to the Reserve Bank of India (RBI) guidelines to ensure that the EMI structure is transparent, fair, and affordable for the borrowers.

Key Elements Impacting Home Loan EMI

There are three primary factors that determine your Home Loan EMI in India:

- Principal Loan Amount: This is the total amount you borrow from the bank. The higher the loan amount, the higher your EMI will be.

- Interest Rate: The rate of interest charged on the loan amount. In India, interest rates can vary between 7% and 10% annually, depending on the bank or financial institution. Additionally, the RBI regulates these rates, ensuring that they remain fair to the borrowers while also protecting the financial stability of the banking system.

- Loan Tenure: The duration over which you will repay the loan. Home loan tenures in India usually range from 5 to 30 years. A longer tenure means lower EMIs but will increase the total interest payout over time.

RBI Guidelines for Home Loans

- Interest Rate Regulation: RBI’s monetary policy directly impacts the interest rates charged by banks on home loans. The central bank often revises the repo rate, which influences the lending rates of banks. When the RBI lowers the repo rate, banks can pass on the benefits to customers in the form of lower interest rates on home loans, which, in turn, reduces the EMI.

- Floating vs. Fixed Interest Rate: RBI allows banks to offer floating and fixed interest rates. Floating rates are linked to the RBI’s repo rate, meaning they change based on market conditions, while fixed rates remain the same for the entire loan tenure. Most Indian banks offer floating rates for home loans.

- Loan-to-Value (LTV) Ratio: RBI has set guidelines for the Loan-to-Value ratio for home loans. The LTV ratio determines how much a bank is willing to lend based on the property’s market value. For example, banks typically offer loans up to 90% of the property’s value for individuals buying homes under ₹30 lakh. For loans above ₹75 lakh, this ratio is generally capped at 75% to 80%.

- Prepayment Penalties: According to RBI guidelines, banks are prohibited from charging a prepayment penalty on home loans with floating interest rates. However, some penalties may apply to fixed-rate loans if you decide to prepay or foreclose the loan.

How to Use a Home Loan EMI Calculator?

Here is a step-by-step guide on how to use a Home Loan EMI Calculator:

1. Input the Loan Amount

Enter the principal loan amount (the total loan amount you are borrowing). You can get this amount based on the market value of the property and the LTV ratio set by the bank.

2. Enter the Interest Rate

Enter the annual interest rate that your bank or financial institution offers. If you’re unsure, this can be obtained from the bank or financial institution providing your home loan.

3. Select the Loan Tenure

Choose the loan tenure in months. Typically, Indian banks offer home loan tenures ranging from 5 to 30 years. While a longer tenure will reduce the EMI, it will increase the total interest paid over the loan’s lifetime.

4. Calculate EMI

Once you’ve entered all the details, click on the “Calculate EMI” button. The calculator will then show you the exact monthly EMI amount you need to pay for your home loan.

Benefits of Using a Home Loan EMI Calculator

- Better Financial Planning: By calculating your EMI in advance, you can adjust your budget accordingly and ensure that your monthly financial obligations align with your income.

- Compare Different Loan Options: A Home Loan EMI Calculator allows you to experiment with different principal amounts, interest rates, and tenures to compare how they impact your EMI.

- No Manual Calculation Required: The EMI calculator automates the entire process, eliminating the need for manual calculations and ensuring accuracy.

- Ease of Use: It’s an easy-to-use tool, which makes home loan decision-making convenient and helps you stay on top of your finances.

Prepayment and Other Considerations

One of the key features of home loan management is the ability to make prepayments. Prepayment allows you to reduce your principal loan amount before the scheduled term ends, helping reduce your total interest liability.

Impact of Prepayment on EMI

- Partial Prepayment: Some banks allow partial prepayment where you can pay an amount upfront to reduce your principal loan amount. This reduces your EMI burden or shortens your loan tenure.

- Full Prepayment: If you make a full prepayment, you can foreclose the loan entirely, thereby ending your EMIs early.

While the RBI has restricted prepayment penalties for loans with floating interest rates, some penalties may apply to fixed-rate loans or under certain terms and conditions. Therefore, it’s always important to check with your lender before making any large prepayments.

Conclusion

Using a Home Loan EMI Calculator is an essential step for anyone looking to apply for a home loan. It helps you understand your monthly obligations and plan your finances accordingly. With the RBI’s stringent regulations, home loan borrowers in India can be assured of fair and transparent loan practices, from interest rates to loan tenures.

By using the Home Loan EMI Calculator and considering all the factors that affect your home loan repayment, you’ll be able to make informed decisions and take full control of your financial future.